Cryptocurrency

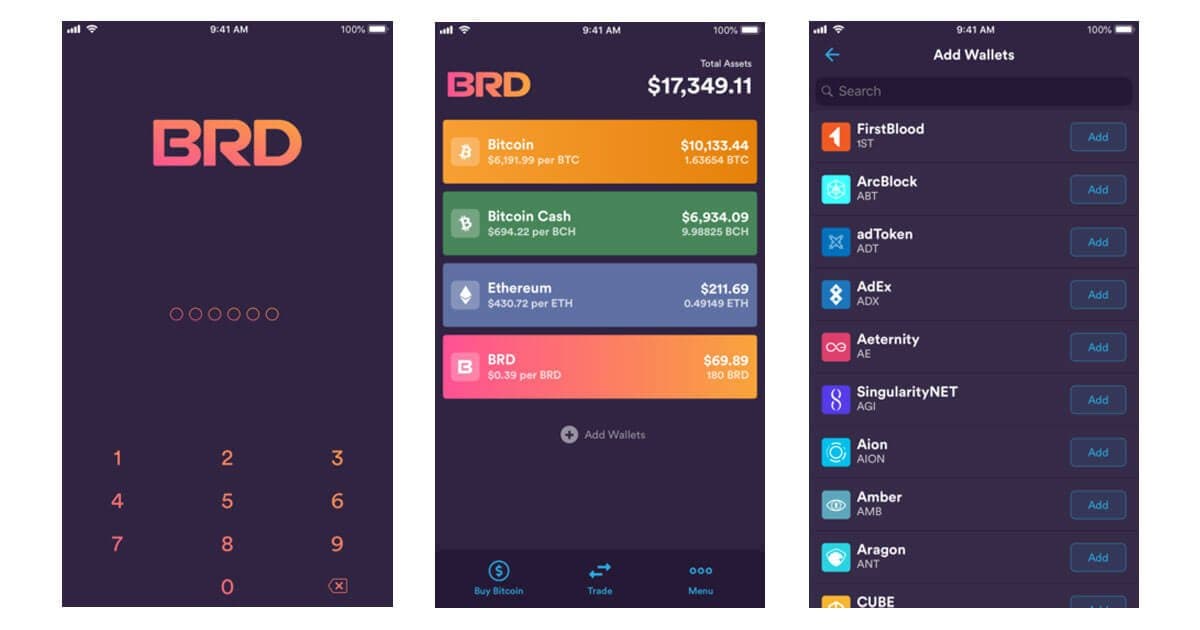

The most popular wallets for cryptocurrency include both hot and cold wallets. Cryptocurrency wallets vary from hot wallets and cold wallets. Hot wallets are able to be connected to the web, while cold wallets are used for keeping large amounts of coins outside of the internet https://aus-casino-gambling.com.

But that does not mean the coin does not hold intrinsic value, and cannot grow to being adopted en mass. Quite the contrary it’s value will only grow as it is adopted by more and more legitimate investors. And the more it is adopted the lower it’s volatility will become, encouraging more to adopt the coin.

Bank of England and the Treasury: While the Bank of England does not directly regulate cryptocurrencies, it monitors developments in the cryptocurrency market to assess potential risks to financial stability. The UK Treasury has also shown interest in exploring the potential for a central bank digital currency (CBDC), which could provide a state-backed digital alternative to cryptocurrencies.

Cryptocurrency wallet

Crypto wallets can be broadly classified into two groups: hot wallets and cold wallets. The main difference is that hot wallets are always connected to the internet while cold wallets are kept offline.

Crypto wallets can be broadly classified into two groups: hot wallets and cold wallets. The main difference is that hot wallets are always connected to the internet while cold wallets are kept offline.

It is important to remember that cryptocurrency transactions do not represent a ‘sending’ of crypto tokens from a person’s mobile phone to someone else’s mobile phone. When sending tokens, a user’s private key signs the transaction and broadcasts it to the blockchain network. The network then includes the transaction to reflect the updated balance in both the sender’s and recipient’s address.

Hardware wallets are physical devices that store private keys offline, providing robust security against online threats. They connect to devices like computers or smartphones only for transactions, ensuring private keys remain isolated. Popular options, such as the Ledger Nano X and Trezor Model T, support multiple cryptocurrencies and offer features like PIN protection and recovery phrases, making them ideal for securing digital assets.

Our editors are committed to bringing you independent ratings and information. Advertisers do not and cannot influence our ratings. We use data-driven methodologies to evaluate financial products and companies, so all are measured equally. You can read more about our editorial guidelines and the investing methodology for the ratings below.

The Nano X hardware is supported by the Ledger Live app, which helps you manage up to 5,500 cryptos, Ethereum and Polygon NFTs and over 1,000 DeFi apps from a single user interface available on both desktop and mobile.

Cryptocurrency market

On October 31, 2008, Nakamoto published Bitcoin’s whitepaper, which described in detail how a peer-to-peer, online currency could be implemented. They proposed to use a decentralized ledger of transactions packaged in batches (called “blocks”) and secured by cryptographic algorithms — the whole system would later be dubbed “blockchain.”

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

The top crypto is considered a store of value, like gold, for many — rather than a currency. This idea of the first cryptocurrency as a store of value, instead of a payment method, means that many people buy the crypto and hold onto it long-term (or HODL) rather than spending it on items like you would typically spend a dollar — treating it as digital gold.

At the time of writing, we estimate that there are more than 2 million pairs being traded, made up of coins, tokens and projects in the global coin market. As mentioned above, we have a due diligence process that we apply to new coins before they are listed. This process controls how many of the cryptocurrencies from the global market are represented on our site.

Hawk tuah girl cryptocurrency lawsuit

The suit includes a dozen plaintiffs who claim to have collectively lost more than $150,000. It alleges that the defendants “leveraged Welch’s celebrity status and connections” and “created a speculative frenzy” in order to jack up the coin’s price as trading began, luring in “first-time cryptocurrency participants” who were drawn to the project as fans of Welch. The complaint contends that Schultz and So violated securities laws, and even indicated their efforts to skirt those laws on the Spaces call. It notes, too, that $HAWK was never registered with the SEC.

But earlier this month, disaster struck when Welch released $HAWK, a cryptocurrency based on her valuable personal brand. Such crypto assets, known as “meme coins,” are known as volatile investments, and tend to trade according to the boom-and-bust cycles of the online phenomena that inspire them. Welch’s coin, developed by partners running a foundation out of the Cayman Islands, spiked in value when it debuted only to crater within hours, plummeting more than 90 percent from a market cap of nearly $500 million to under $30 million.

I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community. I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the…

“The plaintiffs argue that the defendants leveraged Haliey Welch’s celebrity status to create ‘a speculative frenzy that caused the Token’s market value to spike shortly after launch, reaching a significant market capitalization,’” the firms said. “As alleged in the complaint, the defendants engaged in actions that potentially violated federal securities laws.”

The defendants will now have the opportunity to respond to the lawsuit. They are expected to seek a summary judgment to dismiss the case. Should the court deny the summary judgment, pretrial motions will commence, with the plaintiffs seeking a jury trial. A jury would determine the damages to be awarded to investors if it is granted.