Cryptocurrency

These cryptocurrencies are liquid, widely accepted, and backed by strong communities and development teams, so it’s no surprise that beginners seeking a mix of market recognition and growth potential find them attractive https://casino-review-aussie.com. However, the inherent risks of cryptocurrency investment should always be considered.

Leverage may be available when trading crypto, although this will ultimately depend on where you live. Some regulators, such as the FCA, have banned the use of CFDs and leverage when trading crypto, while other regulators are currently working on similar controls.

Bitcoin mining is the process of creating new bitcoin by using computers with specialized chips to solve complicated mathematical puzzles. The first so-called miner to solve the puzzle can earn bitcoin rewards by running such programs using systems that use massive amounts of electricity to mine the cryptocurrencies—a process that has come under criticism because the mining process is not considered environmentally friendly.

One of the most well-known cryptocurrencies is Bitcoin, which was introduced in 2009. However, there are now thousands of different cryptocurrencies available, each with its own unique features and purposes.

Cryptocurrency

CoinMarketCap does not offer financial or investment advice about which cryptocurrency, token or asset does or does not make a good investment, nor do we offer advice about the timing of purchases or sales. We are strictly a data company. Please remember that the prices, yields and values of financial assets change. This means that any capital you may invest is at risk. We recommend seeking the advice of a professional investment advisor for guidance related to your personal circumstances.

According to PricewaterhouseCoopers, four of the 10 biggest proposed initial coin offerings have used Switzerland as a base, where they are frequently registered as non-profit foundations. The Swiss regulatory agency FINMA stated that it would take a “balanced approach” to ICO projects and would allow “legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with national laws protecting investors and the integrity of the financial system.” In response to numerous requests by industry representatives, a legislative ICO working group began to issue legal guidelines in 2018, which are intended to remove uncertainty from cryptocurrency offerings and to establish sustainable business practices.

On 10 June 2021, the Basel Committee on Banking Supervision proposed that banks that held cryptocurrency assets must set aside capital to cover all potential losses. For instance, if a bank were to hold bitcoin worth $2 billion, it would be required to set aside enough capital to cover the entire $2 billion. This is a more extreme standard than banks are usually held to when it comes to other assets. However, this is a proposal and not a regulation.

The very first cryptocurrency was Bitcoin. Since it is open source, it is possible for other people to use the majority of the code, make a few changes and then launch their own separate currency. Many people have done exactly this. Some of these coins are very similar to Bitcoin, with just one or two amended features (such as Litecoin), while others are very different, with varying models of security, issuance and governance. However, they all share the same moniker — every coin issued after Bitcoin is considered to be an altcoin.

In September 2017, China banned ICOs to cause abnormal return from cryptocurrency decreasing during announcement window. The liquidity changes by banning ICOs in China was temporarily negative while the liquidity effect became positive after news.

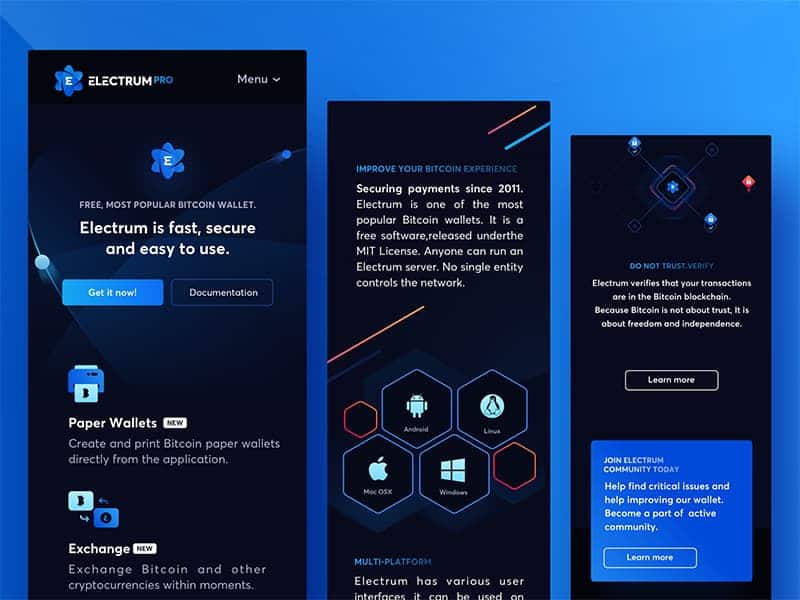

Cryptocurrency wallet

Crypto.com experienced a hack in January 2022 but said no funds were compromised. For security, Crypto.com DeFi Wallet’s features entail two-factor authentications (2FA), password encryption and biometric authentication.

Cryptocurrencies are also speculative assets, which are riskier due to large fluctuations in price. Many active traders invest in them with the hope of making a big profit after their value dramatically increases in the near future — hopefully before a crash.

Consider the story of Dogecoin. A portmanteau of Bitcoin and Doge, the currency was a hit on Reddit, a popular social network forums site, and quickly generated a market value of $8 million. DOGE hit an all-time high of more than $90 billion after Tesla CEO Elon Musk and Reddit users involved in the GameStop short squeeze turned their attention to it.

Our star ratings range from poor (one star) to excellent (five stars). For more details about the categories considered when rating wallets and our process, read our full methodology. Our aim is to provide our independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs. We adhere to strict guidelines for editorial integrity.

Crypto.com experienced a hack in January 2022 but said no funds were compromised. For security, Crypto.com DeFi Wallet’s features entail two-factor authentications (2FA), password encryption and biometric authentication.

Cryptocurrencies are also speculative assets, which are riskier due to large fluctuations in price. Many active traders invest in them with the hope of making a big profit after their value dramatically increases in the near future — hopefully before a crash.

Hawk tuah girl cryptocurrency lawsuit

“I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community,” she wrote on X. “I am fully cooperating with and am committed to assisting the legal team representing the individuals impacted, as well as to help uncover the truth, hold the responsible parties accountable, and resolve this matter.”

Burwick Law, one of the firms representing the investors, said: “Sadly, this is one of many memecoin cases where institutional greed has exploited celebrities and their influence to harm everyday people.”

However, Welch was not named in the complaint which alleges that the defendants used her social media following to market the coin to ’emphasize community engagement, inclusivity, and bridge mainstream culture with the cryptocurrency world’.

The cryptocurrency lost more than 95 percent of its value in a single day when it was released on Dec. 4, seeing its value plunge by $440 million in just 20 minutes. Responding to the lawsuit, Welch wrote on X, formerly Twitter: “I take this situation extremely seriously and want to address my fans, the investors who have been affected, and the broader community.

The choice to go after Welch’s collaborators rather than the self-described “Queen. of Memes” herself suggests what many observers have already assumed: that she played no meaningful role in how $HAWK was conceived or distributed, serving merely as a face to market the token. As Coffeezilla reported, Welch had received an up-front payment of $125,000 to promote the coin to her community, along with 50 percent of net trading proceeds after operating costs paid to third parties. This is in addition to owning 10 percent of the entire $HAWK supply, which she cannot sell for a year. Whether those stakes will amount to anything is anyone’s guess.