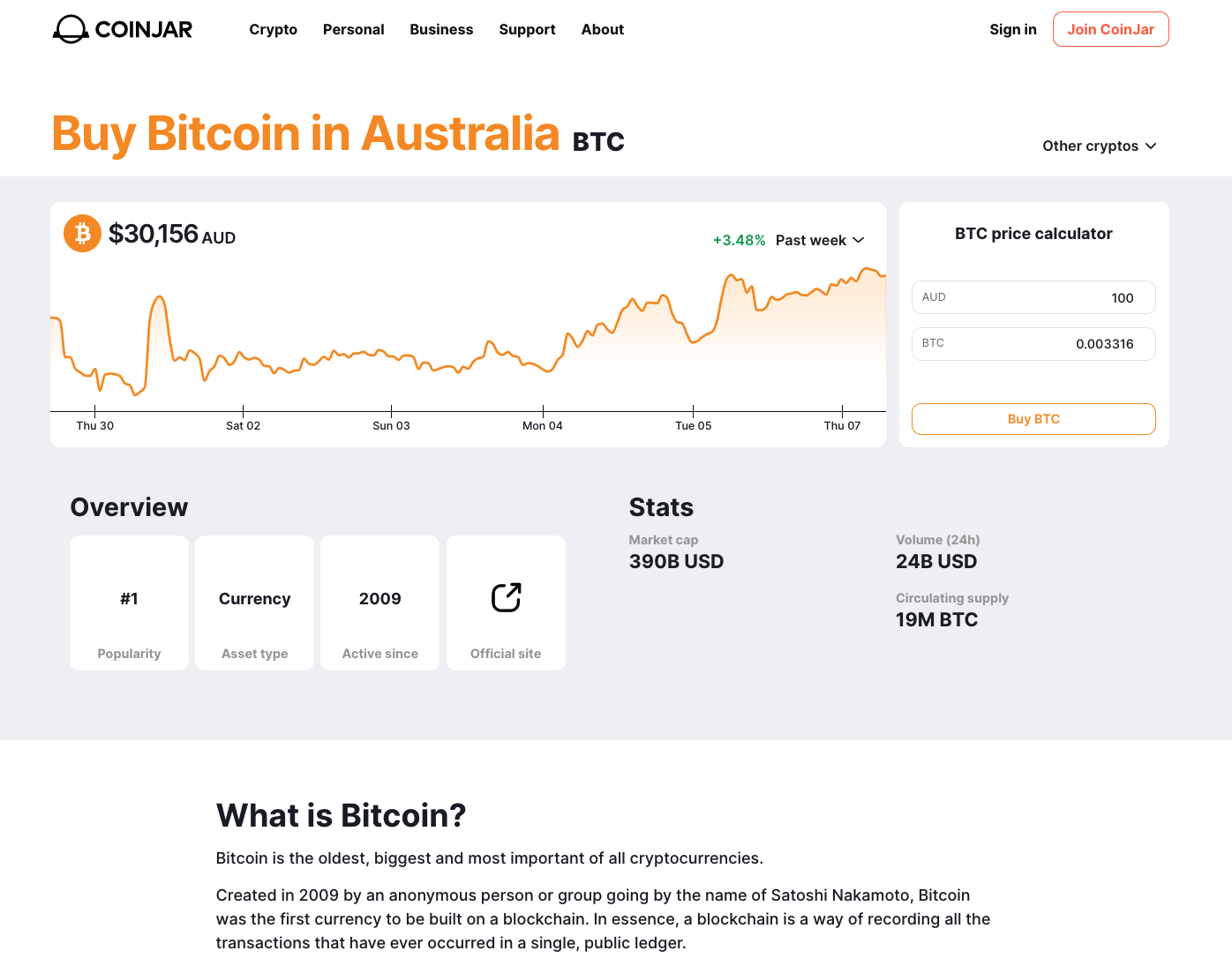

Cryptocurrency prices

However, it’s important to remember that what works well for one person may not be the best fit for another. Therefore, conducting thorough research becomes crucial in selecting the right crypto exchange for you pinnacle bookmaker. To aid in your decision-making process, we have provided detailed reviews of several leading crypto exchange platforms in Australia and worldwide.

Before jumping into the list of the best crypto exchanges in Australia, let’s discuss the situation with cryptocurrencies in this country. Is crypto trading legal here? The answer is: yes, it is. It is legal to store, send and receive, use as a payment method, and, of course, trade a variety of crypto assets.

With Bitaroo, you can also buy Bitcoin with your Self Managed Super Fund (SMSF). Bitaroo also allows you to pay bills with Bitcoin. These features bridge the world of traditional finance with cryptocurrency.

Crypto.com also offers a unique crypto Visa debit card, which is free for any customers who stake at least $500 of CRO (Crypto.com’s own token). You receive various benefits depending on the amount of CRO you stake, and these include Netflix rebates, Spotify rebates, Airbnb rebates, and even complimentary airport lounge access. Not only that, but when you use your Visa debit card to spend AUD or crypto (which you pre-load beforehand), you receive up to 5% cashback paid in CRO on every purchase.

Cryptocurrency market

When to Use: Candlestick charts are best used when traders need a detailed view of price action, including patterns that can predict future market movements. They are particularly useful for identifying market reversals and continuations, making them a go-to choice for day traders and swing traders who rely on quick and accurate interpretations of market sentiment.

Solution: Use a combination of indicators to confirm signals and ensure a more comprehensive analysis. By cross-referencing different tools, traders can validate their insights and reduce the risk of making poor decisions based on incomplete data.

Analyzing crypto charts involves more than just looking at price movements. It requires a combination of tools and techniques to make informed trading decisions. Successful traders use a mix of trend analysis, pattern recognition, and multiple time frame analysis to develop a comprehensive view of the market.

Crypto charts are vital tools that help traders analyze market trends, predict price movements, and make data-driven decisions. In this guide, we will break down the essential components of crypto charts, discuss popular indicators, and provide strategies for analyzing these charts effectively. Whether you are a beginner or looking to refine your chart-reading skills, this comprehensive guide will equip you with the knowledge you need to navigate the complex world of crypto trading.

Explanation: Focusing solely on charts without considering broader market conditions can lead to incorrect conclusions. Market sentiment, news events, and economic factors all play a significant role in price movements.

Hawk tuah girl cryptocurrency lawsuit

But earlier this month, disaster struck when Welch released $HAWK, a cryptocurrency based on her valuable personal brand. Such crypto assets, known as “meme coins,” are known as volatile investments, and tend to trade according to the boom-and-bust cycles of the online phenomena that inspire them. Welch’s coin, developed by partners running a foundation out of the Cayman Islands, spiked in value when it debuted only to crater within hours, plummeting more than 90 percent from a market cap of nearly $500 million to under $30 million.

In the lawsuit filed Thursday against the $HAWK creators in New York District Court, investors accused overHere Ltd, its founder Clinton So, social media influencer Alez Larson Schultz and the Tuah The Moon Foundation of fraudulently selling Welch’s celebrity memecoin, per Hollywood Reporter.

Hailey Welch, best known as the “Hawk Tuah” girl, is in hot water as those involved in launching her cryptocurrency are facing a new lawsuit. The meme-coin she launched lost more than 95 percent of its value in a single day after it released, earlier this month. Lawyers for a group of investors taking legal action say the defendants “sold to the public without proper registration,” as caught by Newsweek. They’ve named the Tuah The Moon Foundation, OverHere Ltd, that company’s executive, Clinton So, as well as the meme-coin’s Los Angeles-based promoter, Alex Larson Schultz.

Hailey Welch blew up online after using the phrase, “hawk tuah,” during a viral YouTube interview. In the time since, she launched her own podcast, Talk Tuah, which has featured numerous celebrity guests, including Wiz Khalifa.

But earlier this month, disaster struck when Welch released $HAWK, a cryptocurrency based on her valuable personal brand. Such crypto assets, known as “meme coins,” are known as volatile investments, and tend to trade according to the boom-and-bust cycles of the online phenomena that inspire them. Welch’s coin, developed by partners running a foundation out of the Cayman Islands, spiked in value when it debuted only to crater within hours, plummeting more than 90 percent from a market cap of nearly $500 million to under $30 million.

In the lawsuit filed Thursday against the $HAWK creators in New York District Court, investors accused overHere Ltd, its founder Clinton So, social media influencer Alez Larson Schultz and the Tuah The Moon Foundation of fraudulently selling Welch’s celebrity memecoin, per Hollywood Reporter.

Cryptocurrency

Binance Coin (BNB) is a form of cryptocurrency that you can use to trade and pay fees on Binance, one of the largest crypto exchanges in the world. Since its launch in 2017, Binance Coin has expanded past merely facilitating trades on Binance’s exchange platform. Now, it can be used for trading, payment processing or even booking travel arrangements. It can also be traded or exchanged for other forms of cryptocurrency, such as Ethereum or bitcoin.

A cryptocurrency is a digital or virtual currency secured by cryptography, which makes it nearly impossible to counterfeit or double-spend. Most cryptocurrencies exist on decentralized networks using blockchain technology—a distributed ledger enforced by a disparate network of computers.

Many banks do not offer virtual currency services themselves and can refuse to do business with virtual currency companies. In 2014, Gareth Murphy, a senior banking officer, suggested that the widespread adoption of cryptocurrencies may lead to too much money being obfuscated, blinding economists who would use such information to better steer the economy. While traditional financial products have strong consumer protections in place, there is no intermediary with the power to limit consumer losses if bitcoins are lost or stolen. One of the features cryptocurrency lacks in comparison to credit cards, for example, is consumer protection against fraud, such as chargebacks.

The Bank for International Settlements summarized several criticisms of cryptocurrencies in Chapter V of their 2018 annual report. The criticisms include the lack of stability in their price, the high energy consumption, high and variable transactions costs, the poor security and fraud at cryptocurrency exchanges, vulnerability to debasement (from forking), and the influence of miners.

Although cryptocurrencies are considered a form of money, the Internal Revenue Service (IRS) treats them as financial assets or property for tax purposes. And, as with most other investments, if you reap capital gains selling or trading cryptocurrencies, the government wants a piece of the profits. How exactly the IRS taxes digital assets—either as capital gains or ordinary income—depends on how long the taxpayer held the cryptocurrency and how they used it.